Overview

Private equity is one of the most rewarding asset classes. We capitalize on our heritage of successful record in finding rewarding opportunities in this field.

Direct Investment

Previous Track Record

Since its inception, The Securities House has been investing in and developing operating companies that add value to the community, at various levels ranging from establishment and full ownership to majority stakes or significant minority stakes. The company has played many roles in this context on a case-by-case basis, such as restructuring companies, developing their business model, increasing their capital, or listing them on the Kuwait Stock Exchange, and providing other advisory services.

Examples of those companies are shown below.

Established in the year 1953 as a sole distribution agent for many multinational research-based pharmaceutical manufacturers and was a market leader in the medical care field when The Securities House listed it on the Kuwait Stock Exchange in 2007.

One of the leading distributors in Kuwait for construction and industrial machines and spare parts. The company exclusively represent well known world-class manufacturers.

Established in 1983 as a joint venture. It offers a range of services varying from hospitality and retail IT solutions to date centers and Smart building infrastructure development.

HPI is a market leader in the manufacturing of hygiene products. Its portfolio includes leading brands of baby care products, wet wipes, feminine care products, and protective care masks.

Established in 2002, Abraaj Water plant was built using the latest state-of-art technology. As a manufacturer and distributor and using scientifically superior ingredients for drinking water and other application through dedication of continuous improvement and innovation, Abraaj was able to build its name as a major national brand in Kuwait.

Kuwait Box company manufactures corrugated cartons and its products and was established in 2007 in Kuwait. It strives to offer its clients the best packaging solutions with superior quality and on-time delivery.

Established in 1975, AREF is amongst the leading investment institutions in the region focusing investments in various sectors and activities.

Established on March 2000 as a Kuwaiti shareholding company and was listed on Kuwait Stock Exchange in November 2004. The company's objectives are to establish non-governmental educational institutions including universities, schools and institutions, as well as to organize and host exhibitions and conferences.

FICO is one of the pioneering companies in the snack food industry in Kuwait.

A leader in the most advanced and exciting healthcare enterprises ever ventured within the private sector of the State of Kuwait.

Harf Information Technology Company was established in 1995, its main activities are programming, internet, solutions, and systems. It has expanded to include the areas of e-learning systems, development of training courses, production of Arabic and Islamic software and applications, websites, and electronic publication of paper books.

Palm Agro Production Company was established in 1982 and has been listed on Kuwait Stock Exchange since March 2002. It operates in the food and beverage sector and focuses on agricultural products.

Private Equity

Since 2017, The Securities House entered the field of acquiring and structuring local private equity yielding investment opportunities in the core operational sectors.

Investment Strategy

- Defensive private equity sectors provide a safe and stable investment class that offers a compelling opportunity for both current income and appreciation across an array of operational activities serving various uses.

- Acquisition of successful companies in local and regional defensive sectors with proven track record, thus ensuring the generation stable income and cash flows.

- Acquisition is based on a proper due diligence and valuation process, thus minimizing value risk.

- Enhancing the business model of the acquired companies to increase profitability.

- Investment horizon of approximately 3-5 years through selling the companies and the realization of attractive returns.

- Ownership through locally licensed non-recourse special purpose vehicles.

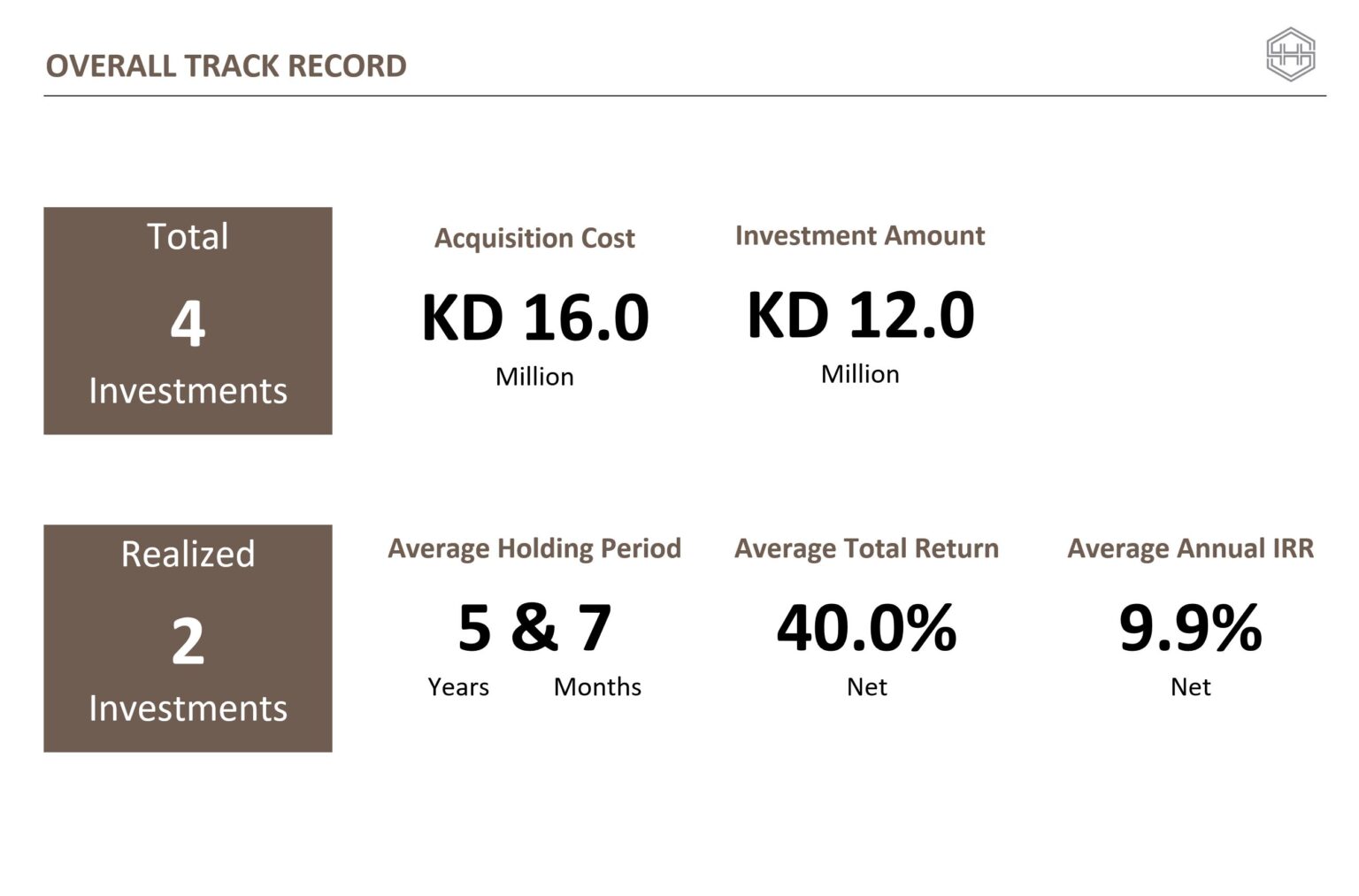

Overall Track Record

Portfolio and Track Record

1. Manarat Educational

Acquisition Date – July 2017

Established in 2004 as an educational services company and initiated a leading bilingual nurseries brand under the name “Hamel Al Mesk”. Over the years, the company’s network grew to 11 nurseries within three governorates in Kuwait. In 2017, The Securities House acquired 80% of Manarat and since then, has worked towards implementing an efficient organizational structure, improving financial management and corporate governance and engaging in business development activities and has acquired the remaining 20% in 2022. Manarat’s long-term goal is to create a comprehensive early year learning platform offering various services that cover all governorates within Kuwait and potentially expand within the GCC.

Manarat Educational Services Company (Manarat or Hamel Al Mesk)

July 2017 – December 2022

Realized

| Sector | E. Education |

| Number of Companies | 1 |

| Stake Acquired | 100% |

| Number of Nurseries | 8 |

| Actual | |

| Holding Period | 5y & 5m |

| Annual IRR | 11.2% |

| Total Return | 61.4% |

2. Juzur Canary

Acquisition Date – July 2018

Canary is a highly reputable quick service restaurant chain in Kuwait that began its operations in the early 1970’s. Canary currently operates six branches across Kuwait serving traditional middle-eastern quick service staple food that embodies Palestinian heritage. In 2018, The Securities House acquired a 70% stake in Canary and since then, has been working closely with the company to update its operations and continue to enhance this local brand and expand its geographical presence within Kuwait and the GCC.

Juzur Canary Restaurant Company (Canary)

July 2018

| Sector | Food |

| Number of Companies | 1 |

| Stake Acquired | 70% |

| Number of Branches | 6 |

3. Dar Al Salam Educational

Acquisition Date – May 2019

Based in Kuwait, in 2019, The Securities House, in partnership with an experienced and well-established company in the educational field on an equal basis, acquired 50% of Dar Al Salam Educational Company, a leading educational company in Kuwait with a track record of over 25 years. Dar Al Salam currently operates a diversified portfolio of schools that offer Indian, Pakistani and IGCSE curriculum to over 6000 students in Kuwait. In 2020, an additional school was launched that will offer premium Indian curriculum within its newly established state of the art campus. Dar Al Salam long-term goal is to expand its footprint and develop a holistic education platform offering different curriculums and services through various channels that combine on-campus, e-learning and a wide array of extracurricular & social activities to enhance its students experience and develop well rounded, community engaged brand ambassadors.

Dar Al Salam Educational Company

May 2019 – December 2024

Realized

| Sector | Education |

| Number of Companies | 1 |

| Stake Acquired | 50% |

| Number of Nurseries | 4 |

| Actual | |

| Holding Period | 5y & 7m |

| Annual IRR | 9.5% |

| Total Return | 32.7% |

4. Hathina Fund

Acquisition Date – January 2023

The Securities House has secured the licensing of the fund by the Capital Markets Authority in Kuwait to acquire 100% of the share capital of Manarat Educational Services Company in January 2023, which was established in 2004 as an educational services company and initiated a leading bilingual nurseries brand under the name “Hamel Al Mesk”. Over the years, the company’s network grew to 11 nurseries within three governorates in Kuwait. Manarat’s long-term goal is to create a comprehensive early year learning platform offering various services that cover all governorates within Kuwait and potentially expand within the GCC

Hathina Fund for Early Education

Owner of:

Manarat Educational Services Company (Manarat or Hamel Al Mesk)

January 2023

| Sector | E. Education |

| Number of Companies | 1 |

| Stake Acquired | 100% |

| Number of Nurseries | 11 |

| Acquisition Cost | KD 2,700,000 |

| Investment Amount | KD 3,000,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR | 12.0% |

| Total Return | 60.0% |

| Actual | |

| Distribution Yield | 8.0% |