Overview

The Securities House recognizes the importance of international real estate sector as it has always been a safe asset class. We mainly focus on rewarding investment opportunities and provide our clients with distinctive returns.

Since 2017, The Securities House distinguished itself in the field of structuring and syndicating yielding real estate investment opportunities with medium-term duration in the international markets, especially in the United States.

International Yielding Real Estate Investments

Investment Strategy

- Strategic partnerships with renowned real estate development and management partners who have acquired, developed and/or managed over $6 billion in industrial real estate throughout the United States, the United Kingdom and Europe.

- Industrial real estate is a large, stable, and diversified investment class that offers a compelling opportunity for both current income and appreciation investors across an array of industrial property types serving various uses.

- Acquisition of core plus, mission critical real estate properties in prime industrial sub-markets with no premiums paid, thus minimizing value risk.

- Acquired properties are fully leased on a long-term basis to investment-grade and/or credit quality tenants, thus ensuring the generation stable rental revenue.

- Investment horizon of between 3-5 years through selling the properties and the realization of attractive returns.

- Ownership through offshore non-recourse special purpose vehicles to minimize taxable income and maximize Investor returns.

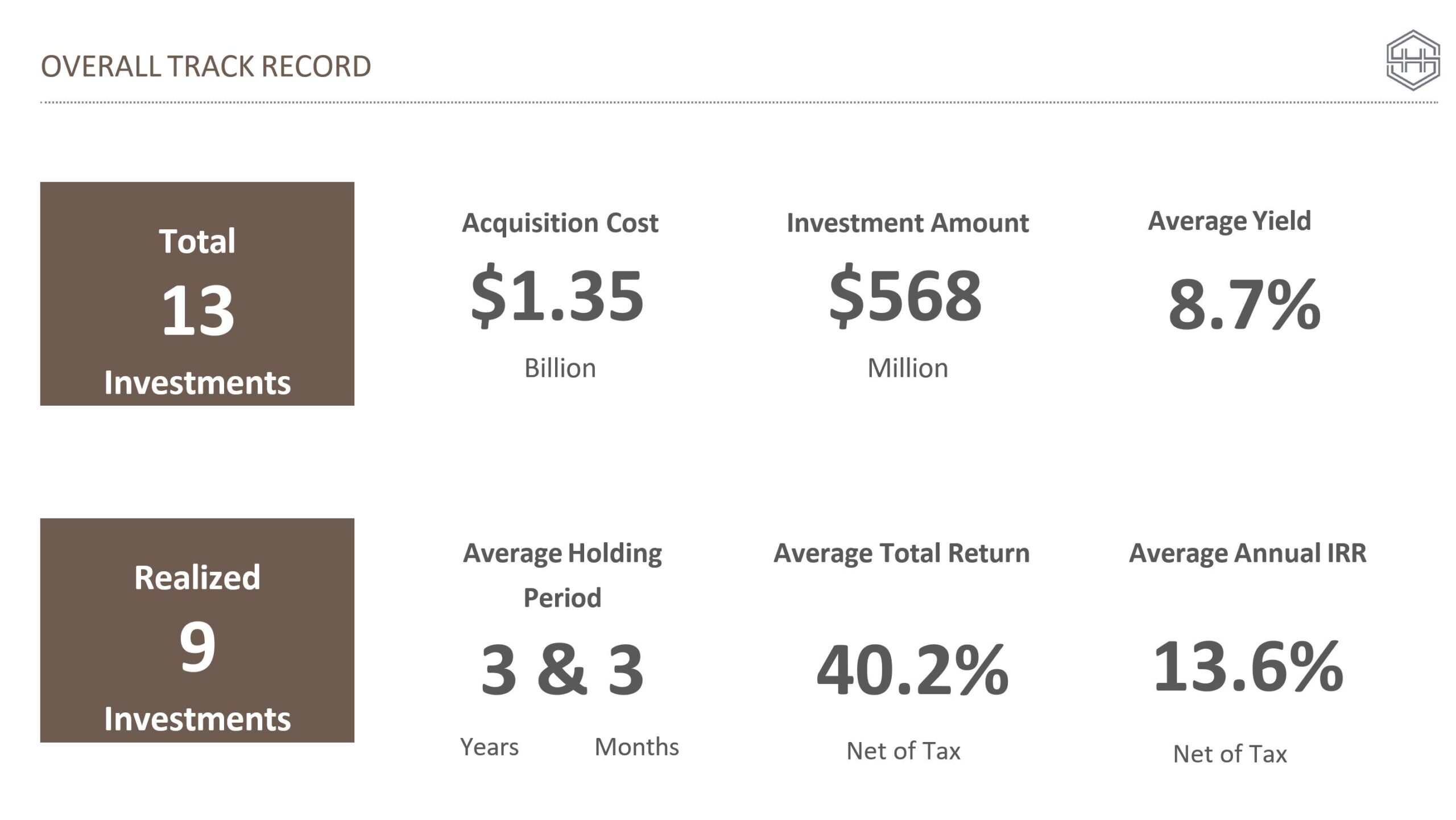

Overall Track Record

Portfolio and Track Record

1. Rolls Royce, UK

April 2011 – February 2014

Realized

| Number of Properties | 1 |

| Net Built-up Area | 542,000 SF |

| Acquisition Cost | £51,700,000 |

| Investment Amount | £19,700,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 10.0% |

| Total Return (net of tax) | 29.0% |

| Actual | |

| Holding Period | 2y & 10m |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 10.3% |

| Total Return (net of tax) | 31.3% |

2. USIP, USA

June 2012 – August 2014

Realized

| Number of Properties | 24 |

| Net Built-up Area | 3,400,00 SF |

| Acquisition Cost | $163,800,000 |

| Investment Amount | $59,700,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 10.0% |

| Total Return (net of tax) | 51.0% |

| Actual | |

| Holding Period | 2y & 2m |

| Distribution Yield | 9.0% |

| Annual IRR (net of tax) | 14.1% |

| Total Return (net of tax) | 29.2% |

3. USIP II, USA

June 2012 – August 2014

Realized

| Number of Properties | 21 |

| Net Built-up Area | 4,000,000 SF |

| Acquisition Cost | $183,900,000 |

| Investment Amount | $67,600,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 10.0% |

| Total Return (net of tax) | 50.0% |

| Actual | |

| Holding Period | 2y & 2m |

| Distribution Yield | 9.0% |

| Annual IRR (net of tax) | 16.3% |

| Total Return (net of tax) | 28.1% |

4. USIP III, USA

July 2013 – October 2017

Realized

| Number of Properties | 26 |

| Net Built-up Area | 3,500,000 SF |

| Acquisition Cost | $160,800,000 |

| Investment Amount | $58,500,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 9.0% |

| Total Return (net of tax) | 45.0% |

| Actual | |

| Holding Period | 4y & 3m |

| Distribution Yield | 9.0% |

| Annual IRR (net of tax) | 10.4% |

| Total Return (net of tax) | 43.3% |

5. USIPA, USA

August 2014 – March 2018

Realized

| Number of Properties | 6 |

| Net Built-up Area | 2,700,000 SF |

| Acquisition Cost | $128,000,000 |

| Investment Amount | $56,084,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 9.0% |

| Total Return (net of tax) | 46.0% |

| Actual | |

| Holding Period | 3y & 7m |

| Distribution Yield | 8.9% |

| Annual IRR (net of tax) | 10.6% |

| Total Return (net of tax) | 31.1% |

6. Omega, UK

September 2014 – December 2017

Realized

| Number of Properties | 1 |

| Net Built-up Area | 315,000 SF |

| Acquisition Cost | £17,500,000 |

| Investment Amount | £17,500,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 7.0% |

| Total Return (net of tax) | 20.0% |

| Actual | |

| Holding Period | 3y & 3m |

| Distribution Yield | 6.5% |

| Annual IRR (net of tax) | 15.8% |

| Total Return (net of tax) | 37.9% |

7. USIPA II, USA

June 2017

| Number of Properties | 7 |

| Net Built-up Area | 3,460,000 SF |

| Acquisition Cost | $138,400,000 |

| Investment Amount | $61,400,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 9.0% |

| Total Return (net of tax) | 46.5% |

| Actual | |

| Distribution Yield | 8.75% |

8. SIP, USA

September 2017 – December 2022

Realized

| Number of Properties | 11 |

| Net Built-up Area | 2,500,000 SF |

| Acquisition Cost | $105,000,000 |

| Investment Amount | $42,400,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 10.0% |

| Total Return (net of tax) | 51.0% |

| Actual | |

| Holding Period | 5y & 3m |

| Distribution Yield | 9.25% |

| Annual IRR (net of tax) | 13.0% |

| Total Return (net of tax) | 63.8% |

9. Bluelinx, USA

January 2018 – April 2021

Realized

| Number of Properties | 4 |

| Net Built-up Area | 2,150,000 SF |

| Acquisition Cost | $113,800,000 |

| Investment Amount | $44,550,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 9.0% |

| Total Return (net of tax) | 45.0% |

| Actual | |

| Holding Period | 3y & 3m |

| Distribution Yield | 9.5% |

| Annual IRR (net of tax) | 15.6% |

| Total Return (net of tax) | 56.6% |

10. USIPA III, USA

June 2019 – February 2022

Realized

| Number of Properties | 3 |

| Net Built-up Area | 1,130,000 SF |

| Acquisition Cost | $48,900,000 |

| Investment Amount | $20,000,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 9.0% |

| Total Return (net of tax) | 46.0% |

| Actual | |

| Holding Period | 2y & 8m |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 18.9% |

| Total Return (net of tax) | 57.6% |

11. GIP, USA

November 2021

| Number of Properties | 8 |

| Net Built-up Area | 1,560,000 SF |

| Acquisition Cost | $84,000,000 |

| Investment Amount | $28,000,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 9.0% |

| Total Return (net of tax) | 46% |

| Actual | |

| Distribution Yield | 8.25% |

12. USIPA IV, USA

June2024

| Number of Properties | 2 |

| Net Built-up Area | 600,000 SF |

| Acquisition Cost | $62,700,000 |

| Investment Amount | $31,750,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 9.0% |

| Total Return (net of tax) | 46% |

| Actual | |

| Distribution Yield | 8.0% |

13. EIP, Europe

September 2024

| Number of Properties | 3 |

| Net Built-up Area | 803,000 SF |

| Acquisition Cost | €71,300,000 |

| Investment Amount | €46,000,000 |

| Target | |

| Holding Period | 5 Years |

| Distribution Yield | 8.0% |

| Annual IRR (net of tax) | 9.0% |

| Total Return (net of tax) | 45.0% |

| Actual | |

| Distribution Yield | 8.0% |